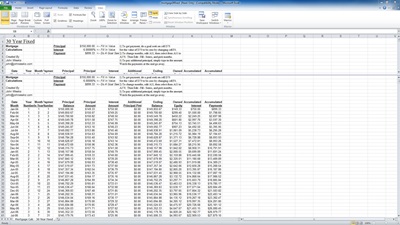

Principal and interest: Your loan principal is the exact amount you borrow from the lender.In this case, you could opt to recast your mortgage, which won’t change your loan term or interest rate but can lower your monthly payments with a shorter amortization period. Lump-sum payment: If you have extra money in the bank, you might decide to put it toward your mortgage-this is known as making a lump-sum payment.This can also save you money on interest. Extra payments: If you’d like to pay off your loan faster, making extra payments could be a good strategy.A portion of this will go toward your loan principal while the rest will go toward interest. Monthly payment: This is how much you’ll be required to pay each month.For example, if you have a 15-year loan, you’ll make roughly 180 monthly payments. Number of payments: This represents the total number of monthly payments you’ll make over the loan term.Common mortgage terms include 10, 15 and 30 years, though other terms are also available. Loan term: This is the number of years you have to repay your mortgage.Your mortgage interest rate represents how much you’ll be charged in interest, expressed as a percentage of your loan principal. Interest rate: Lenders charge interest in return for allowing you to borrow money.Loan amount: This is the amount you borrowed from your mortgage lender to cover the purchase of your home.Mortgage Amortization Calculator Definitions You also have the option to indicate if you plan to make any extra payments to get an idea of how much you could save on interest and if you could shorten your repayment time. You’ll also see your total interest costs and total repayment costs as well as your estimated payoff date. After entering the loan amount, repayment term, interest rate and loan start date, you’ll see how much your monthly payments will be and how many payments you’ll owe over the life of the loan. In practice, there may be differences between the timing of the loan repayments and the timing of the interest charges being added to the loan balance.Īpplications for new monies will require a minimum term of 5 years.How to Use the Mortgage Amortization CalculatorĪ mortgage amortization calculator can be a helpful tool to estimate how your payment schedule will break down month by month. Timing of interest conversion - The calculator assumes that interest is charged to the loan account at the same frequency as the repayments are made. The calculator assumes that the interest rate will remain the same throughout the mortgage term. Interest rate - The interest rate input is a nominal rate and is used to calculate the total interest payable over the mortgage term.

30 year mortgage payment calculator full#

Rounding of repayment amounts - The calculator uses the unrounded repayment to derive the amount of interest payable over the full term of the loan. Monthly repayments – The calculator divides the mortgage amount and the total interest payable by the total number months in the mortgage term. Please ensure you obtain a personalised Mortgage Illustration before making a decision to proceed with a mortgage. The figures provided by this calculator are for information purposes only.

0 kommentar(er)

0 kommentar(er)